Evidence from cash transfers at scale in Kenya suggests that demand-side policies or stimulus may be very effective at raising output without creating inflationary pressure when there is a lot of ‘slack’ in the economy.

Editor’s note: This is the second of two articles covering the paper “Slack and Economic Development”. Read the first article – “How low demand constrains productivity and economic development” here.

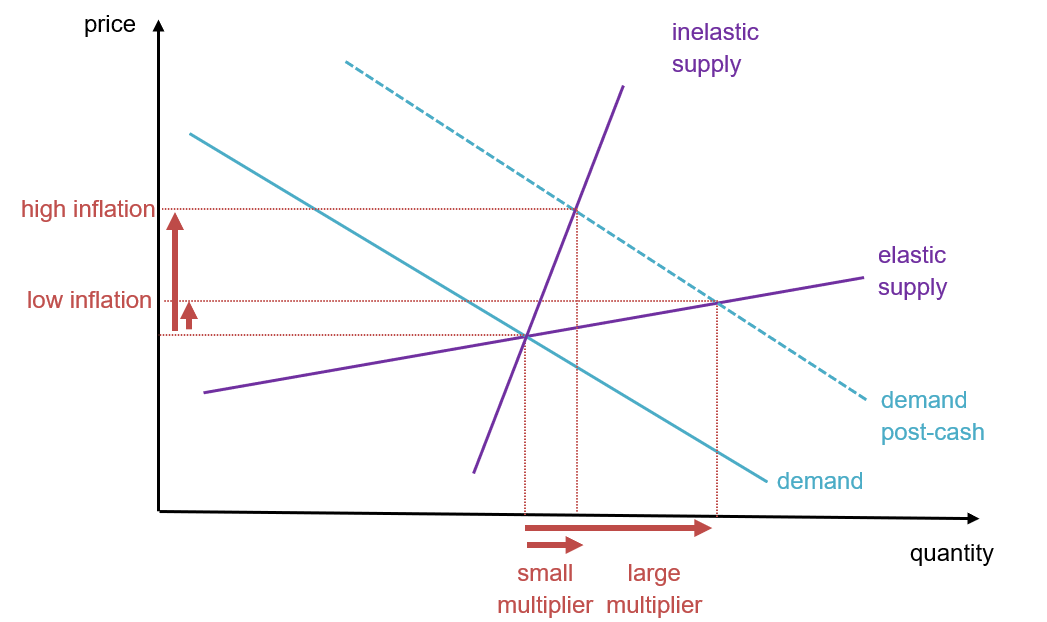

Whether cash transfers or fiscal stimulus cause inflation is a longstanding debate in economics. From a macroeconomic perspective, the key determinant of the output-inflation trade-off is whether the increased demand created by cash-induced spending can be met by increased supply. When supply can more easily be increased (what economists call more elastic aggregate supply, see Figure 1), inflation will be lower. This is important, as inflation eats away the ‘real’ effects of demand stimulus, leading to lower real multipliers. Inflation also determines the winners and losers of such programmes. Those not receiving cash transfers might plausibly be hurt by rising inflation rates, or they could gain from income flowing into their hands through economic interactions with recipients.

Figure 1: Supply and demand after a cash transfer

A similar argument may apply cross-sectionally within countries – that is, when we look at whether local prices increase in places receiving large influxes of cash relative to other places within the same country. This type of setting has been a popular subject of empirical investigation, as it ‘nets out’ any responses of monetary policy, which is common across regions within a country (e.g. Nakamura and Steinsson 2014). Whether local supply responds flexibly, may again depend on slack, but also on a region’s access to larger markets through trade, enabling it to import the additional supply at a fixed price, and the local competitive structure of the economy.

How can we test these macroeconomic theories in the real world?

To test these theories, one would ideally assign cash transfers to local economies that are large enough to affect market-level prices and create sufficient variation in exposure across relevant markets. For instance, a labour market may be more local than the market for tradable goods, where prices might move in tandem everywhere. The handful of randomised controlled trials that have looked at the price impacts of cash transfers have – even for locally very large injections of cash – found either minimal impacts on prices overall (Egger et al. 2022), only in a small subset of remote markets (Cunha et al. 2019), or only on a small subset of goods (Filmer et al. 2018), suggesting that local supply, at least in the developing country settings that are studied, is able to respond quickly (i.e. it is highly elastic).

How can we rationalise such elastic supply? Our story is one where indivisibilities in small firms lead to a situation where many firms operate below capacity. That is, there may be a lot of slack in economies with many small firms and low demand, not just during recessions, but in steady state during normal times (read the first article in this series for an exposition of how we model this type of environment).

The macroeconomic effects of cash transfers

To assess our model’s ability to quantitatively explain the inflationary impacts of cash, we apply it to a recent large-scale cash transfer experiment that took place in Siaya County, a rural area in Western Kenya on a major trade route between Mombasa port and Kampala (Egger et al. 2022). This programme was exceptionally large. The NGO GiveDirectly gave poor rural households unconditional USD 1000 cash transfers amounting to 75% of annual household income. The programme was randomised across villages, and its intensity varied across groups of villages generating variation in the amount of cash flowing into local markets. In treated villages, the programme amounted to 15% of local GDP (see our VoxDevTalk for more information). This unique setting and the spatial data collected before and after cash transfers allow us to exactly replicate this experiment within the model. To do so, we first match the model to data of the study area economy from before the cash was transferred (at baseline). Then, we simulate the experiment in the model and compare its predictions against the empirical evidence.

How effective are cash transfers in general equilibrium?

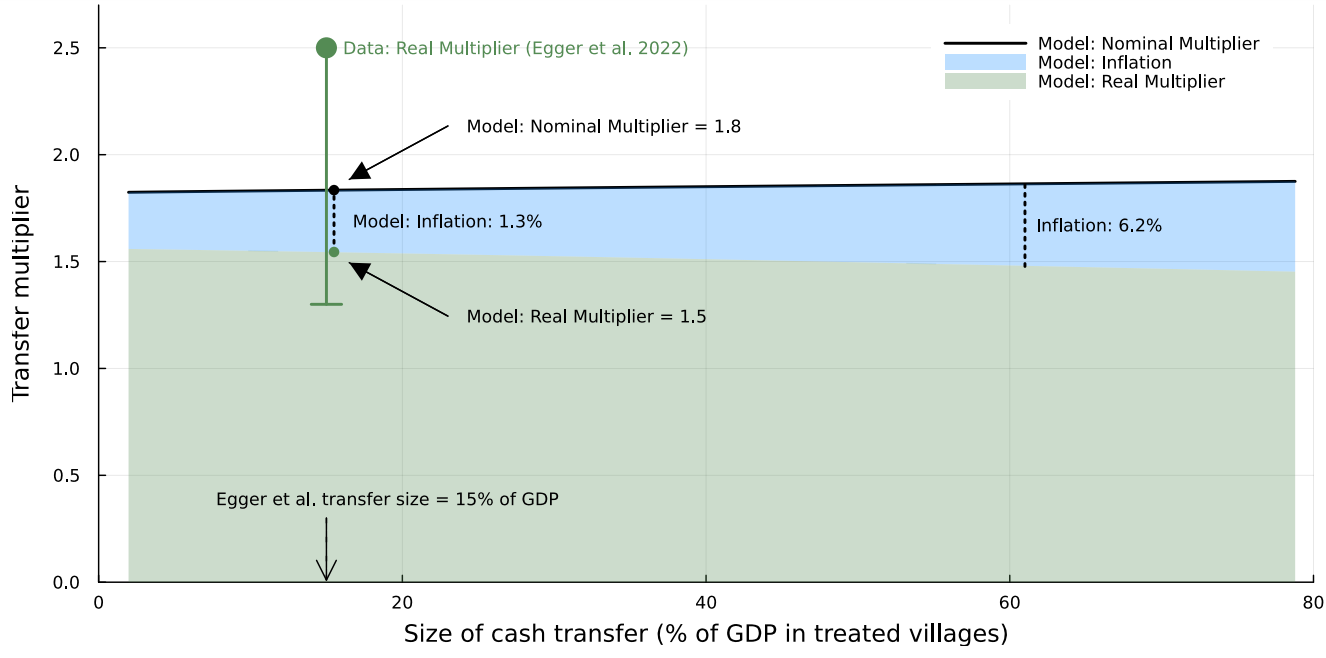

Our model of Western Kenya has two key predictions about the impacts of cash transfers. First, cash allows households to purchase goods from abroad. Second, and more importantly, the demand stimulus increases output in locally produced goods by raising utilisation rates and thus labour productivity. These productivity effects raise the model implied multiplier by 0.5 (above the benchmark multiplier of 1); that is, for every dollar transferred to the local economy, production of non-tradable goods goes up by 50 cents as a result of reduced slack. Overall, the predicted real multiplier of 1.5 suggests that our simple model is capable of explaining a substantial share of the large multipliers found in experimental work in the Egger et al. (2022) study – who found a multiplier of 2.5 – and other empirical work in developing countries (Gerard et al. 2021). Strikingly, Figure 1 shows that large multipliers persist for even larger stimulus policies than the one we study in Kenya. Our model allows for this possibility because labour mobility out of agriculture helps meet demand for non-tradable goods, echoing an important idea in Lewis (1954).

Figure 2: Nominal and real multipliers at different transfer sizes

Notes: This figure shows the nominal (thick black line) and real, net of inflation multipliers (in green) of cash transfer as a function of the size of the transfer on the horizontal axis. Arrows indicate estimates for a transfer of a size comparable to 15% of GDP, which corresponds to the size of the Egger et al. (2022) experiment. The empirical estimate from that study is added for comparison, with its one-sided confidence interval (the green whisker).

Can you raise output without inflationary pressures?

Using our model, we are able to comprehensively assess the inflationary impacts of cash transfers, a key concern for any policy aiming to raise demand. Typically, policymakers are concerned about stimulus outside recessions raising prices, and the experiment in Western Kenya took place during a period of sustained growth. Despite this, our model predicts low inflation of 1.3% for a transfer on the order of 15% of GDP in treated villages, in line with the low inflation found empirically. In both model and data, the limited inflationary impacts tend to be heterogeneous across space, with low slack and more central or busy markets experiencing the largest price increases. Slack thus explains why the output multipliers with respect to cash transfers or other demand stimulus are large, while inflationary impacts remain muted.

These findings make two additional contributions: First, they are quantitatively inconsistent with a story of firms with market power raising prices and markups to increase profits (as in Cunha et al. 2019). If this were driving price effects, we would have seen prices in remote markets with more slack rise by more, as firms there face less competition. Second, the model allows us to quantify to what extent prices may have risen overall within the entire study area, including control areas. This ‘missing intercept’ is a concern for empirical studies comparing more and less exposed regions – if prices rise everywhere, this comparison will underestimate inflationary impacts. We find that this is likely the case for Egger et al. (2022), who may have missed up to 50% of the overall increases in prices. But with inflation as low as they document, this still would not make a big difference quantitatively in this setting.

Broader policy implications for cash transfers at scale

The widely documented success of cash transfers in raising economic well-being has led to policy interest to introduce these programmes at even larger scales and outside of the rural areas where most of the existing evidence comes from. Our model allows us to bridge this gap and predicts generally lower multipliers and higher inflation in urban areas. Cities are plausibly characterised by greater potential for part time work to overcome indivisibilities, tighter economic integration of markets and less scope to absorb workers out of agriculture. These factors all lower baseline slack, lowering the effectiveness of demand side policies.

More broadly, we should expect higher inflationary impacts cash transfers (and thus lower real multipliers) in setting with less slack (or unemployment), in places more integrated to trade with larger market (resulting in increased demand that lowers slack) and in settings where cash transfers directly affect an increase in supply, such as when they lower entry barriers for entrepreneurs due to binding credit constraints.

References

Cunha J M, G De Giorgi, and S Jayachandran (2019), "The price effects of cash versus in-kind transfers," The Review of Economic Studies 86(1): 240–281. https://doi.org/10.1093/restud/rdy018

Egger D, J Haushofer, E Miguel, P Niehaus, and M Walker (2022), "General equilibrium effects of cash transfers: Experimental evidence from Kenya," Econometrica 90(6): 2625–2672. https://doi.org/10.3982/ECTA17945

Filmer D P, J Friedman, E Kandpal, and J Onishi (2018), "Cash transfers, food prices, and nutrition impacts on nonbeneficiary children," Policy Research Working Paper 8377, The World Bank.

Gerard F, J Naritomi, and J Silva (2021), "Cash transfers and the local economy: Evidence from Brazil," CEPR Discussion Paper 16286, CEPR Press, Paris & London. https://cepr.org/publications/dp16286

Keynes J M (1936), The General Theory of Employment, Interest, and Money.

Lewis W A (1954), "Economic development with unlimited supplies of labor," The Manchester School 22: 139–191. https://doi.org/10.1111/j.1467-9957.1954.tb00021.x

M Walker , N Shah, E Miguel, D Egger, F S Soliman, T Graff (2024) “Slack and Economic Development”