Bundling health insurance with microcredit reduced out-of-pocket health expenses by 50% among informal workers in Burkina Faso without decreasing microcredit uptake, offering a promising pathway to universal health coverage.

Editor’s note: For a broader synthesis of themes covered in this article, check out Issue 3 of our VoxDevLit on Microfinance.

Universal health coverage remains a significant challenge in sub-Saharan Africa, particularly for informal workers who fall outside traditional insurance schemes. Out-of-pocket health payments can reach up to 73% of total health expenditures in Cameroon, exacerbating economic inequalities and contributing to household impoverishment. Most approaches to extend health insurance coverage struggle with low voluntary enrolment rates and limited financial viability. Recent research highlights that traditional contributory insurance schemes often fail due to premium barriers, equity concerns, and limited additional resources mobilised for health (Yazbeck et al. 2023).

In this context, innovative approaches that address multiple barriers simultaneously are urgently needed. We evaluate a comprehensive solution in Ouagadougou, Burkina Faso, where less than 10% of the population currently has health insurance coverage (Boutin et al. 2025).

Studying the impact of bundling health insurance with microcredit loans

Voluntary health insurance consistently faces low enrolment due to limited demand for health services (Platteau et al. 2017). Making health insurance a requirement for loan access allows our model to use the trusted relationships that microfinance institutions have built with informal workers—a sector typically underserved by conventional insurance schemes. This mandatory approach overcomes challenges of limited willingness to pay, poor understanding of insurance benefits, and lack of trust in insurance mechanisms that typically result in inadequate risk pooling.

Previous mandatory approaches have faced significant challenges. In India, Banerjee et al. (2014) documented how a similar bundling programme led to substantial microcredit dropout, with clients preferring to forego loans rather than accept bundled insurance. In Bangladesh, Rabbani et al. (2022) found better acceptance of employer-bundled health insurance, but their model offered limited coverage focused primarily on inpatient care, leaving beneficiaries vulnerable to common outpatient expenses.

Our model extends beyond simply bundling health insurance with microcredit loans and avoids these pitfalls by providing truly comprehensive coverage that includes medications and diagnostic tests—critical components that often drive catastrophic health expenditures among low-income households. For a monthly premium of approximately US$1.5, members and up to three household dependents received coverage for both outpatient and inpatient care with a 60% reimbursement rate. The programme design enhances effectiveness through several key features: no caps or deductibles, direct billing arrangements with healthcare providers to eliminate upfront payment barriers, and dedicated facilitators providing ongoing education and support. This integrated approach successfully transforms theoretical coverage into actual healthcare access by simultaneously addressing the financial, administrative, and knowledge barriers that have undermined previous insurance initiatives in similar contexts.

Table 1: Benefit package of the micro health insurance product

| Features | Description |

| Eligibility | Mandatory for new loan applicants; optional for members using only savings services |

| Premium | Approximately $1.5 per month (covers the subscriber and up to three additional household members) |

| Coverage Period | Matches the duration of the loan |

| Covered Services | General and specialised consultations, medications (excluding drugs for chronic conditions), deliveries, hospitalisation, tests, and diagnostic examinations |

| Not Covered Services | Costs related to chronic conditions and specific specialties (e.g. ophthalmology, dentistry) |

| Deductible/Copayment | No deductible, no ceiling; 40% copayment |

| Payment Modality | Prepayment in contracted facilities; reimbursement after claims for non-contracted facilities |

| Type of Providers | Public facilities in microcredit group areas; selected private facilities in the same areas |

Source: Boutin and al. (2025).

Using a randomised controlled trial to study the impact of bundling

We implemented a cluster randomised controlled trial (RCT) to evaluate the impact of bundling health insurance with microcredit loans in Ouagadougou, Burkina Faso. In January 2020, we randomly assigned 101 microcredit groups to treatment (49 groups) or control (52 groups) conditions. Our final analysis covered 88 active groups (44 treatment, 44 control) and 1,095 individuals who reported illness episodes in the six months preceding our January 2022 endline survey.

Our mandatory design ensured all individuals in treatment groups received coverage, avoiding selection bias issues common in voluntary enrolment studies. We measured several key outcomes: financial protection (through out-of-pocket expenditures and payment difficulties), healthcare utilisation patterns (including type and timing of care), and overall health outcomes. We also analysed administrative records from 4,325 insurance claims submitted between August 2020 and December 2021.

Bundling improved financial protection and healthcare access

Our findings demonstrate substantial positive impacts from bundling health insurance with microcredit. First, the mandatory nature of the insurance did not deter participation in the microcredit programme—loan renewal rates remained stable between 35-45% for both treatment and control groups throughout the study period. This indicates high acceptability of the bundled product among microcredit clients. Compliance with the insurance scheme was also high, with 92% of individuals in treatment groups enrolled.

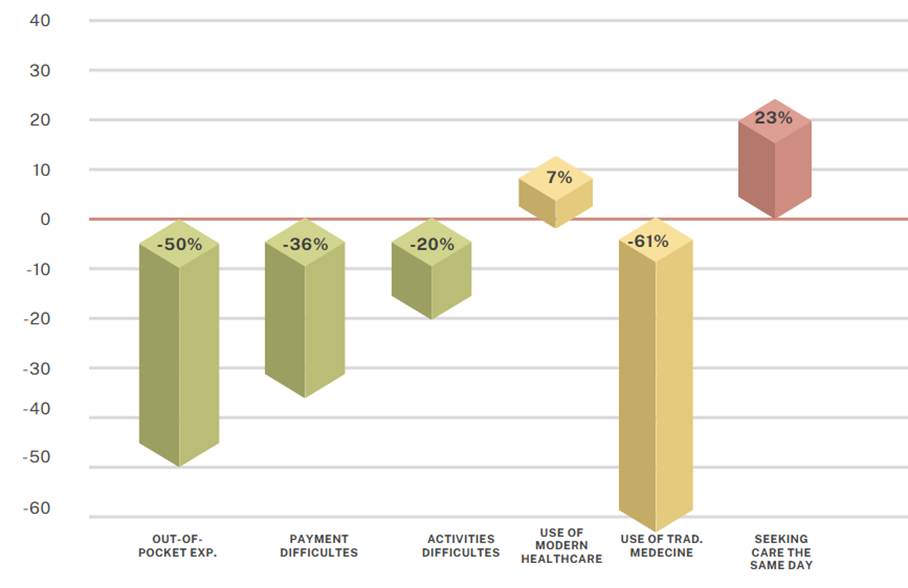

Figure 1: Key significant results

Source: Boutin et al. (2025).

The insurance significantly improved financial security: out-of-pocket expenditures decreased by over 50% among insured individuals, the likelihood of experiencing payment difficulties for medical treatment fell by 36%, and the negative impact of healthcare expenses on income-generating activities was reduced by approximately 20%.

We observed important shifts in healthcare-seeking behaviour: modern healthcare facility use increased by 7%, while reliance on traditional medicine decreased by 61%. Administrative data showed that half of all insurance claims were for primary care services, with 76% processed through direct prepayment.

Importantly, insurance changed not just where but when people sought care. Insured individuals were 23% more likely to seek treatment on the same day symptoms appeared and 12% more likely within two days, suggesting the removal of financial barriers that typically delay care-seeking.

Despite these positive effects, we found no significant impact on physical or emotional health outcomes during our study period, indicating that health improvements may require longer timeframes to materialise.

Policy implications for universal health coverage

Our findings demonstrate that bundling health insurance with microcredit can effectively expand health coverage to informal workers in sub-Saharan Africa. Unlike previous interventions, our approach achieved high acceptance and utilisation without disrupting microcredit operations.

For policymakers pursuing universal health coverage goals, our results offer several practical insights:

- Leveraging existing financial inclusion platforms can efficiently reach populations traditionally excluded from formal health financing schemes, avoiding the need to build entirely new enrolment systems.

- Comprehensive benefit packages that include outpatient care and medications drive higher utilisation and greater financial protection. Drug and diagnostic costs are increasingly recognised as major sources of catastrophic health expenditures.

- Implementation quality matters tremendously. The high satisfaction reported by insured members (92% could name their beneficiaries, and members rated satisfaction 8/10 on average) reflects the importance of ongoing support beyond initial enrolment.

- The absence of microcredit dropout demonstrates that when insurance delivers tangible value, mandatory participation can be acceptable even to cost-sensitive populations.

For countries seeking to advance toward universal health coverage, this model could be adapted to various contexts where microfinance has strong penetration, potentially covering millions of previously uninsured individuals. However, sustainability requires careful attention to premium pricing, benefit design, and implementation quality. Future research should examine longer-term health impacts and explore similar bundling approaches with other services to reach broader segments of the informal economy.

References

Banerjee, A, E Duflo, and R Hornbeck (2014), “Bundling health insurance and microfinance in India: There cannot be adverse selection if there is no demand”, American Economic Review, 104(5): 291–297.

Boutin, D, L Petitfour, Y Allard, S Kountoubré, and V Ridde (2025), “Comprehensive assessment of the impact of mandatory community-based health insurance in Burkina Faso”, Social Science & Medicine, 117870.

Platteau, J-P, O De Bock, and W Gelade (2017), “The demand for microinsurance: A literature review”, World Development, 94: 139–156.

Rabbani, A, J Mehareen, I A Chowdhury, and M Sarker (2022), “Mandatory employer-sponsored health financing scheme for semi-formal workers in Bangladesh: An experimental assessment”, Social Science & Medicine, 292: 114590.

Yazbeck, A S, A L Soucat, A Tandon, C Cashin, J Kutzin, J Watson, S Thomson, S N Nguyen, and T Evetovits (2023), “Addiction to a bad idea, especially in low- and middle-income countries: Contributory health insurance”, Social Science & Medicine, 320: 115168.