Impacts of the basic services

Since the launch and success of M-PESA, and the launch of mobile money services across many countries in the developing world, there has been a lot of research around what role systems like M-PESA can play and what impacts they can have on economies. So, what are the possible mechanisms through which mobile money systems can affect developing economies?[1]

All mobile money systems have transaction fees and so do not really encourage cashless retail transactions in the way credit cards or debit cards have in the United States. Instead, in most countries they are largely used to make two types of transactions: (a) geographically disparate transactions, i.e. transactions across space, and (b) transactions where the opportunity cost of holding cash may be high, as in high-crime cities (see Economides & Jeziorski 2015). For these types of transactions, mobile money provides a dramatic reduction in transaction costs, as well as improvements in convenience, security, and time taken for the transaction. For example, in Kenya, the average transaction travelled 200 km in 2008 (Jack & Suri 2011), which would be an approximately $5 bus ride – instead, consumers paid a $0.35 fee (given the average transaction size). In addition, the mobile money agents are much more easily accessible (see Table 2) than any other financial institution, so the money sent via this system can be easily deposited and withdrawn.

Given these reductions in transaction costs and improvements in safety, mobile money could simply facilitate trade both on the intensive margin (making existing transactions more efficient), and on the extensive margin (enabling transactions that would not have happened without mobile money). Such facilitation of trade could result in a better allocation of capital and, thus, increase savings. Similarly, there could be an improvement in the allocation of human capital as the returns to migration improve. In addition, mobile money accounts may provide safe storage of savings and potentially reduce precautionary savings (though improving the efficiency of person to person transfers), thus potentially increasing total savings as well as improving the allocation of savings and risk (via increased and more efficient remittances) across households and firms. In Kenya, researchers found that mobile money boosted entrepreneurship by reducing theft (and therefore output losses), while speeding up entrepreneur-supplier transactions and raising the valuation of trade credit (Beck et al. 2018). Mobile money may also have effects on intra-family dynamics, as these accounts are individually held. Finally, on the macroeconomic side, mobile money systems could increase the velocity of money and inflation (though the evidence is mixed on this, as discussed below). In economies with dual currencies, like that of Somaliland (see Iazzolino 2015), mobile money could facilitate trade, remittances, and transactions in US dollars.

Economides & Jeziorski (2015) study the demand for mobile money, exploiting a natural experiment created by an exogenous and unanticipated increase in the transaction fees in Tanzania. They identify the slope of the demand curve and compute consumers’ willingness to pay for risk amelioration using transportation and storage transactions. They find that consumers who execute large transactions are usually more price inelastic than consumers who execute smaller transactions and that demand for long- distance transfers is less elastic than that for short-distance transfers. Consumers use the mobile money network extensively for extremely short-term storage (less than 2 hours), probably due to high levels of street crime and burglaries, and are willing to pay up to 1% of the transaction amount to avoid carrying money in the form of cash for each extra kilometre and up to 1.1% to avoid keeping money at home for an extra day.

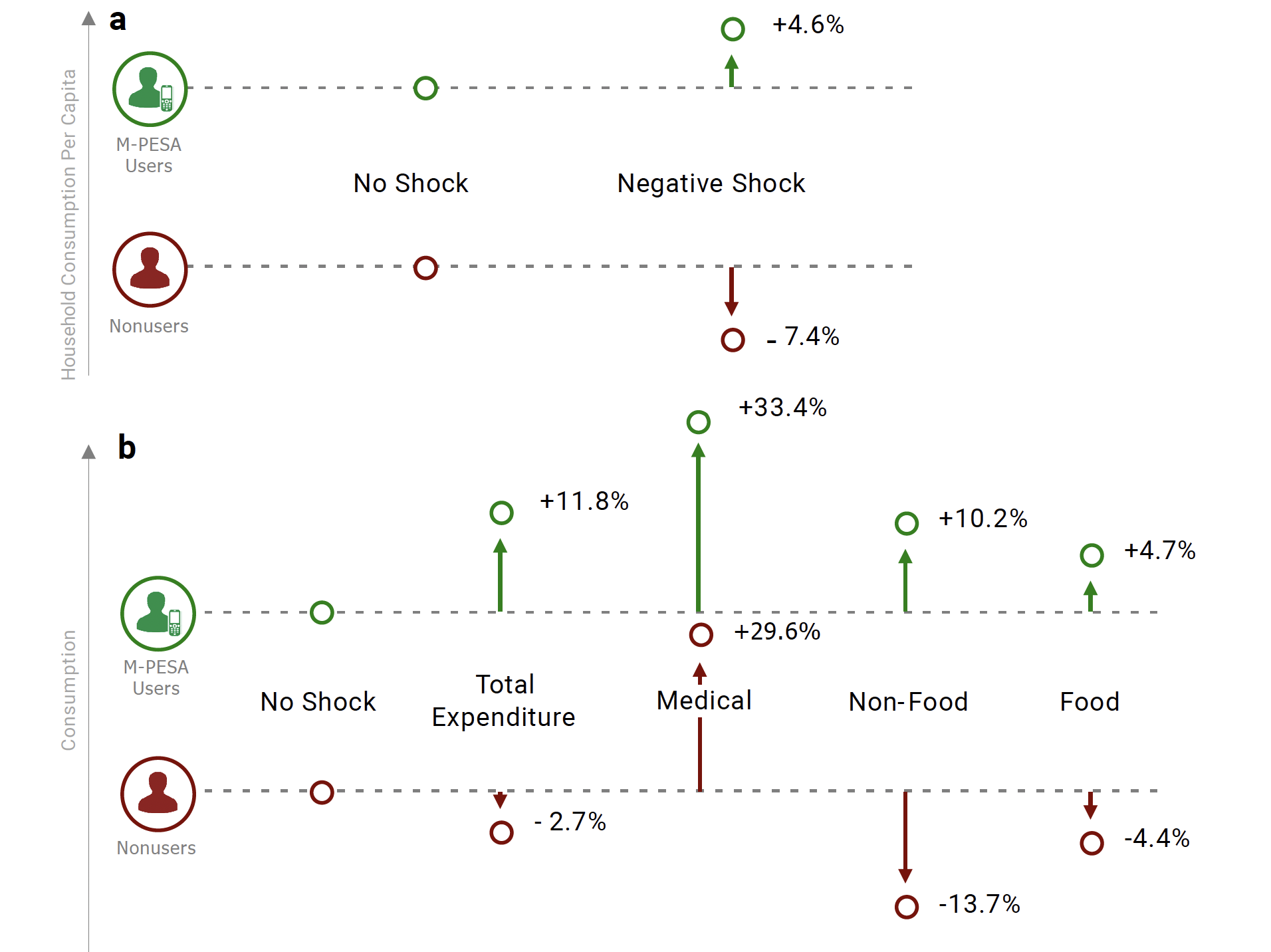

Looking at the impacts of mobile money in Kenya, Jack & Suri (2014) use the survey data described above to understand how M-PESA has improved the ability of households to share risk. Informal risk-sharing networks are used extensively to pool risk in developing economies[2], including in Kenya (see Suri 2014). Given the prevalence of such relationships, which involve transfers of money between households, and given the large transaction cost reductions afforded by M-PESA[3], M-PESA could have important impacts on the efficiency with which individuals spread risk. As Jack & Suri (2014) show, these effects are sizeable – Figure 7a illustrates their findings. Households with M-PESA are better able to smooth risks, and their consumption is less sensitive to shocks. When subject to a shock, households that have mobile money are more likely to receive a remittance from friends and family, receive more money in total, and receive it from a more diverse set of people in their network, all resulting in efficiency gains in risk sharing. This also explains why a large share of transactions on M-PESA are P2P remittances across long distances. Apeti (2023) finds similar consumption smoothing results, i.e. a reduction in consumption volatility, for a large sample of developing countries, mostly due to improved financial inclusion and increased remittances.

Figure 7: Resilience of M-PESA users and nonusers to economic shocks. Panel a is based on data from Jack and Suri (2014); panel b is based on data from Suri et al. (2012)

In complementary work, Suri et al. (2012) look specifically at how M-PESA affects people’s response to health shocks. They find that M-PESA users are able to spend more on medical expenses in the event of a health shock while also increasing expenses on food and maintaining their education expenditure. Nonuser households or households far from agents are unable to increase expenditure on food after the shock, decrease their non-food subsistence expenditure, and might pull children out of school to finance health care costs. When hit by an illness shock, nonusers substitute away from non-medical expenses, such as nonfood subsistence, to finance the needed medical care expenditure. The authors find no evidence that nonusers suffer significant food reductions, suggesting that both users and nonusers do not cut back on necessary consumption. Non-users seem mostly to substitute away from their children’s education to fund their health shocks. These results are illustrated in Figure 7b. Ahmed and Cowan (2021) see similar results with respect to health shocks in Western Kenya, finding that mobile money helps households spend more on health care, through increased access and utilisation of informal loans.

Finally, using the last round of their panel survey conducted in 2014, Suri and Jack (2016) measure the longer-term impacts of M-PESA. They find that better access to mobile money services has increased household consumption and savings and, thus, reduced poverty rates by 2 percentage points. This is equivalent to 196,000 households moving out of extreme poverty, and the reductions were larger among female-headed households. They also find significant changes in occupation choice, largely among women, who moved away from agriculture as their main occupation to business and retail. As a result of M-PESA, 186,000 women made this transition.

In a randomised control trial newly introducing mobile money in rural areas of Mozambique, Batista and Vicente (2022) confirm the findings by Jack and Suri (2014) when following households in both treated and control locations over three years: after major floods affected some of the experimental areas in 2013, households in treated locations were better able to smooth their consumption and reported being less vulnerable to episodes of hunger. This same response occurred in response to household idiosyncratic shocks. This consumption smoothing behaviour happened as a result of increased migrant remittances to households affected by shocks, as shown by both mobile money administrative records and remittance reports from household surveys. Households affected by shocks and who lived in areas where mobile money was available were in this way provided with extra resources to attend shock-related expenditures without the need to cut on food expenditure.

Mobile money also changed the spatial allocation of rural households who, after the introduction of mobile money, were more likely to send out-migrants and to receive remittances. Batista and Vicente (2022) posit that these movements are a product of improved risk-sharing through mobile money and argue that mobile money is a likely driver of urbanisation and structural change. This can presumably explain the observed increase in the perceived well-being and decreased vulnerability of treated households.

Using a randomised experiment in Northern Uganda, Wieser et al. (2019) finds evidence that mobile money adoption is associated with positive economic effects. Introducing mobile money resulted in cost savings for those sending and receiving remittances, doubled the non-farm self-employment rate from 3.4 to 6.4% and reduced the number of households with very low food security from 62.9 to 47.2%. Mobile money access also changes health-seeking behaviour amongst women in Uganda. Egami and Matsumoto (2020) find that mobile phone adoption positively affected antenatal care take-up, and eased liquidity constraints facing rural households who typically travel long distances to access healthcare.

Batista and Vicente (2022) find that households in villages where mobile money was available were less likely to keep actively farming their land, similarly to Suri and Jack (2016). This agricultural disinvestment effect is strengthened over time, as treated household members emigrate out of rural areas - a treatment effect that also strengthens over time. This migration treatment effect of mobile money is consistent with the hypothesis that the introduction of mobile money reduced the transaction costs associated with long-distance transfers and in this way improved household-level insurance possibilities, which incentivised migration. While the explanation for agricultural disinvestment in Suri and Jack (2016) was occupational change, the result in Batista and Vicente (2022) points to the introduction of mobile money creating a different type of occupational change that involves geographic mobility.

In Kenya, Gürbüz (2017), using self-collected survey data and an instrumental variable strategy, finds that mobile money use leads to households being 16-22% more likely to save and increases average household savings by 15-21% of average household income ($2.74-3.72).

In Tanzania, Riley (2018) uses a panel difference-in-difference specification to examine village spillovers from the use of mobile money services. She finds that mobile money improves risk sharing for households that use mobile money but does not have spillovers to non-user households within the same village. Mobile money use makes it more likely a household receives remittances and increases the value of remittances received after a village-level rainfall shock, such as a drought or flood. Also in Tanzania using the same data source, Abiona and Foureaux Koppensteiner (2018) find that use of mobile money services protects households from sliding into poverty after a rainfall shock, and enables households to maintain investment in human capital. Pople et al. (2021) examines the effect of mobile money cash transfers by the World Food Program (WFP) to households in a flood-prone area of Bangladesh, finding that households receiving payments were 36% less likely to go a day without eating.

For Uganda, Munyegera & Matsumoto (2014) use panel survey data to show that using mobile money is associated with a 69% increase in household per capita consumption, mobile money subscribers are 20 percentage points more likely to receive remittances from their family members in town, and the total annual value of remittances received is 33% higher compared to non-user households.

Using survey and administrative data on M-PESA in Kenya, Jack et al. (2013) study the impact of mobile money on the volume, reach, direction, and type of internal remittances. They find that M-PESA users are more likely to receive and send remittances (by 37.4 and 34.3 percentage points, respectively). This includes an increase in the frequency (two more transactions per round) and amount of remittances. The reach of transactions is, on average, 100 km greater for M-PESA users, and reciprocity is also greater for M-PESA users (they are 13.2 percentage points more likely to engage in at least one reciprocal transfer). Finally, M-PESA users are more likely to transact for regular support, credit, and insurance purposes, and they change the composition of remittances by shifting from regular support purposes to credit arrangements.

Using qualitative methods, Morawczynski (2009) finds that M-PESA usage increased during periods of violence, like the post-election violence in 2007 in Kenya, and resulted in a reduced vulnerability to consumption shocks. Morawczynski & Pickens (2009) find that M-PESA increases savings for both the banked and unbanked, improves women’s empowerment, and facilitates transfers within networks during bad events. Plyler et al. (2010) find community-level effects of M-PESA in terms of money circulation and local employment; physical, financial, and food security; greater financial, human, and social capital accumulation; and an improvement in the business environment, as transactions are easier.

Aside from these initial studies on mobile money, there are a number of recent field experiments studying the impact of mobile money. Batista & Vicente (2013) study the initial rollout of a mobile money product, mKesh, in Mozambique. In the treatment areas, there was intense mobilisation of agents and information dissemination (agents were recruited and trained, and community theatre and community meetings were organised to disseminate mKesh). In addition, randomly chosen households in treatment areas were provided with individual information and support in self-registering for a mobile money account. Using both survey, behavioural and administrative data, the authors find that, in terms of take-up, 76% of individually targeted individuals conducted at least one transaction on the system. In terms of impact, financial literacy, the trust in local agents, and the usage of mCel (the accompanying telco), financial services were higher in treatment areas. In addition, the overall willingness to remit (independently of the money transfer mechanism) increased, though the overall willingness to save did not increase significantly. As with the studies on M-PESA, the remittance aspect of mobile money seems to be the most salient.

In Bangladesh, Lee et al. (2017) use an information treatment to encourage use of mobile banking accounts by rural households with a migrant member to facilitate urban to rural remittance flows. The information and training in mobile money increased use by 200% compared to the control group. Migrants from treated households that used the account sent home 30% more remittances by value, leading to substantial welfare improvements for the rural household in terms of increased expenditure, increased saving, reduced borrowing and improved health. Rural households that experienced a rainfall shock were better able to insure against it.

Aggarwal et al. (2020) study mobile money use amongst microentrepreneurs in urban Malawi, using an RCT with three different treatments that vary the cost of using mobile money. They find that most treated individuals opened accounts and also used them. In terms of economic outcomes, they find that the treatment entrepreneurs shift some of their labour from their business to agriculture, with no other clear impacts. However, it does seem that the entrepreneurs are not using their mobile money accounts for transfers, but instead to save.

Kipchumba and Sulaiman (2021) study the effects of mobile money on women’s empowerment. In particular, they use national data from Kenya to show that mobile money increases the control over their personal finances for both men and women, but the effects are larger for women. However, they do not find that this then also affects how other household decisions are made.

Impacts of related and augmented services

Blumenstock et al. (2016) study the response to shocks (in the context of an earthquake in Rwanda) using administrative data on mobile phone records, airtime purchases, and transfers of airtime. They find, as a result of the earthquake, a modest increase of $84 in airtime transferred and an increase of $16,959 in value of calls made, potentially indicative of indirect transfers as the caller bears the cost of the call in Rwanda. They also find that transfers were more likely to be sent to wealthier individuals and to individuals with a history of reciprocity with the sender.

Recent work has also exploited the potential of mobile money to promote the development of microenterprises. Batista et al. (2020) worked with 1270 microentrepreneurs operating in a relatively homogenous setting in Maputo, the capital city of Mozambique. They evaluate the impact of a 2x2 randomised experiment implemented in 2014, where microentrepreneurs were provided, depending on their treatment status, with mobile money accounts paying interest on savings for a limited amount of time and/or financial management training. This study finds that removing financial and management constraints had a positive impact on female-owned business performance but had no detectable effect on male-owned businesses – with a treatment effect equivalent to approximately 120 USD/month (35% of the average monthly profits in the control group). In terms of mechanisms, the evidence shows that financial management training increased understanding of financial management skills in the short and long-run, whereas there was limited impact on savings but increased confidence in the ability to save more in the future. Administrative mobile money records show that microentrepreneurs in the experimental groups provided with interest-bearing mobile money accounts were more likely to conduct all types of mobile money transactions, with some evidence of increased effects of the combined intervention.

Two other papers-in-progress examine the effect of providing mobile money accounts to female entrepreneurs. Riley (2022), in Uganda, examines the impact of disbursing microfinance loans through a mobile money account instead of the usual method of cash. She finds disbursement of loans through the mobile money account leads to an 11% increase in the value of business capital and a 15% increase in business profits, with the proposed mechanism an improved ability to resist sharing pressure from the woman’s spouse. She sees that the mobile money account is used for the safe storage of the loan, rather than for transactions, and so the initial deposit of the loan onto the mobile money account is crucial for it to have a positive impact on the business. The household as a whole is also better off when the woman receives the microfinance loan on a mobile money account, suggesting wider benefits from improving women’s control of resources. Bastian et al. (2018) in Tanzania, examine the effect of providing mobile saving accounts through a mobile money account (M-Pawa) to female entrepreneurs with and without a business training. They find that after 6 months, treated women are saving more in the mobile saving account, saving less in other forms of saving and obtaining more micro-loans through the mobile saving account. The savings accounts increase women’s reported control over how their business money is spent.

Another RCT also explored the potential of mobile money as a secure saving device. In Kenya, Dizon et al. (2017), randomly assigned a mobile money account labelled for saving to women. They found that the initiative increased savings while reducing risk sharing. However, the reduced risk sharing was more than compensated for by the increased savings improving women’s ability to manage risk, resulting in an overall improvement in women’s ability to manage shocks.

To evaluate the impact of promoting mobile savings on agricultural modernisation, Batista and Vicente (2020) implemented a randomised control trial with farmers in the Manica province of Mozambique. The randomised intervention incentivized savings in the period that mediated between harvest and planting seasons. All farmers participating in the experiment had no prior access to mobile money and were offered identical mobile money accounts, except that the treated farmers were paid interest on balances held in their mobile money accounts over a three-month period between harvest and planting. As a result, treated farmers exhibited significantly higher savings, were more likely to use fertiliser in their land, by 31- 36 percentage points, as well as to use other agricultural inputs.

There has also been a growing body of literature that tries to understand the applications of mobile money, i.e. other aspects and circumstances where mobile money could play a role. For example, Aker et al. (2014) conduct the first randomised controlled trial (RCT) involving mobile money in the specific context of cash transfers. To reduce malnutrition during the drought and the 2009–2010 food crisis, households in Niger were given monthly unconditional cash transfers, with women as the primary beneficiaries. The authors compared: (a) a cash arm, where households received the transfer manually; (b) a Zap[4] arm, where transfers were received via mobile money and households were also given a service-enabled mobile phone; and (c) a mobile arm, where the transfers were received manually but households were also given a mobile phone. There was no pure control group. Recipients of mobile money transfers had better nutrition, with a 10–16% more diversified diet, including greater proportions of protein and energy-rich food, and their children ate 33% more of a meal per day. The authors argue that these effects came from reduced time costs for the recipients, with mobile money transfer recipients saving, on average, 2 days over a 5-month period. Despite the small magnitude of this effect, it could have had a significant opportunity cost because it occurred during the planting season. Another potential mechanism increasing bargaining power for women is the increase in privacy, given that the transfer was less observable to other household members. The electronic nature of the cash transfer did not, however, lead to significant use of mobile money beyond the programme. Finally, the authors also show that, although total costs were higher in mobile money villages (due to the distribution of phones), per-transaction costs were 20% lower. With appropriate infrastructure, mobile money could, therefore, significantly reduce costs of cash transfers to disbursing agencies.

Blumenstock et al. (2015b) design an experiment to study mobile salary payments in seven provinces across Afghanistan between August 2012 and March 2013. The intervention provided employees in a firm with a mobile phone and training on using M-Paisa, a mobile money service, and randomly assigned half of them to receive their salary through M-Paisa as opposed to cash. The authors use survey and administrative data and find significant cost reductions for the operating agency but no significant impacts of mobile money use on the recipients.

Blumenstock et al. (2018) conduct a field experiment with automatic payroll deductions toward savings through M-Paisa via a new salary platform called M-Pasandaz. Employees were randomised into the following groups: (a) different default contribution rates from salary to a savings account (0% or 5%, which they could choose to change) and (b) different matching contribution rate from the firm (0%, 25%, or 50%). These were cross-randomizations, creating a 2×3 design with a total of six treatment groups. The authors find that employees enrolled in the 5% deduction rate were 40 percentage points more likely to save and that a 50% matching rate had comparable results to the 5% deduction for saving. The main explanation for this striking result seems to be present-bias preferences, where the employee procrastinates when making a non-default contribution.

Breza et al. (2020) conduct a field experiment in Bangladesh to measure the impact of moving garment factory workers from cash to digital wage payments. The workers, most of them women, were randomised into the following groups: (a) workers who received a bank or mobile money account as well as direct wage payments; (b) workers who got an account but were not enrolled in digital payroll;(c) workers who continued to receive wage payments in cash. They find evidence that financial capability comes from experience and ‘learning-by-doing’. Workers enrolled in digital wage payments conduct fewer transactions with the help of bank agents, and carry out more transactions on their own. Compared to workers in the mobile-money account-only group, these workers are 24 percentage points more likely to make a send- money transaction and 60 percentage points more likely to make a withdrawal from their account without receiving assistance. They added an audit study where actors posing as factory workers were sent to conduct mobile money transactions with local agents and find that agents operating around factories that pay electronic wages are less likely to take advantage of women customers, such as adding on extra fees.

Blumenstock et al. (Forthcoming) study the relationship between violence and financial decisions in Afghanistan. Using data from an RCT administered to increase mobile money take-up and combining this with administrative data, a nationally representative household survey, and behavioural field experiments, the authors find that people increase their cash holdings when exposed to violence, and that people experiencing violence are less likely to transact in mobile money, and hold less funds in their mobile money accounts. They argue that the mechanism underlying these effects is a demand for liquidity that arises from the fear of future violence. In particular, a one standard deviation increase in individual forecasts of violence is associated with holding 20% less mobile money and 20% more cash. This suggests that violence may play an important role in preventing the development of formal and digital financial networks.[5]

Apeti and Edoh (2023) look across a large sample of 104 developing economies between 1990 and 2019 to study how mobile money affects tax revenues. They find that mobile money increases tax revenues, both through indirect and direct tax revenues (though the effect on direct tax revenues is larger). For the former, they show that this effect is largely coming from taxes on goods and services. For the latter, they find that these effects are driven by personal and corporate income taxes.

In an ongoing field experiment, Habyarimana & Jack (2016) study an innovative savings and credit product that layers over M-PESA, called M-Shwari (we discuss this innovation in more detail in Section 5). They study M-Shwari in a set of schools in Kenya using a field experiment with two treatment arms: a commitment (locked) savings arm and a regular savings arm (with a cross-randomization of text message reminders to save for education). The intervention was targeted to the transition between primary and secondary school. The authors find an increase in savings and in secondary school enrollments for both groups relative to the control (though the effects are not significantly different across the two groups).

Dalton et al. (2022) run an RCT with small and medium enterprises in Kenya to understand the adoption and impacts of an e-payment technology. This technology is called Lipa na M-PESA and is an “add-on” to the mobile money system in Kenya (M-PESA). It allows users to pay retailers for goods and services without any charge (on the back end, the retailers pay the fees for M-PESA, in a similar way to how Visa and Mastercard operate). They find that this e-payment technology increases the access to digital credit by 50%, and while it reduces the volatility in sales (more so for smaller firms), it does not change revenues or profits directly.

Mobile credit and banking services

In 2011, Safaricom partnered with a local bank in Kenya, the Commercial Bank of Africa (CBA), to create a new banking product called M-Shwari. Since then, CBA has launched similar products in Tanzania (M-Pawa) and Uganda, Rwanda, and Cote d’Ivoire (MoKash). Similar platforms are provided by Equity Bank Kenya (Equitel) and Kenya Commercial Bank (KCB M-PESA). With M-Shwari, consumers can use their mobile phone to open a bank account at CBA, deposit money in it by transferring balances from M-PESA, withdraw from it via M-PESA, and request a loan. Underlying the loan decision is a credit scoring rule or algorithm based on administrative data on airtime purchases and mobile money transactions (in Uganda, the product is based on a machine-learning credit scoring and credit limit assignment algorithm).[6] By April 2015, over 10 million Kenyans had an M-Shwari bank account, and some, for the first time, had access to formal financial services.[7] A company called Branch offers a slightly different form of mobile credit (with no savings component, as they are not a bank). To make a lending decision, the product asks for permission to scrape the applicant’s phone for data on handset details, GPS info, call and SMS logs, social network data from Facebook, and contact lists. A machine-learning algorithm then uses these data to create a credit score and make a lending decision. Increased usage of the product results in lower interest fees and larger loans. The company Tala provides a very similar product to that of Branch. Similarly, M-KOPA and Angaza (two other systems in Kenya) offer asset-based financing for solar panels where payments on the loan are made from M-PESA.

Suri et al. 2021 study the credit aspect of M-Shwari in Kenya. They find large take up rates of M-Shwari, but that this does not substitute for other sources of credit, so represents a true expansion in the access to credit. In addition, they find that this credit helps consumers deal with health shocks, in particular, and therefore improves resilience. They also find that it increases the propensity to spend on education. Finally, they do not find that it affects any other economic outcomes, like consumption and wealth.

Related, Brailovskaya et al (2021) study digital credit in Malawi and show that they harm consumers’ own perceived well-being. Running a financial literacy program for these consumers increased knowledge and loan demand but not timely payments, which ultimately meant more default due the demand effects.

Riley and Shonchoy (2022) use a field experiment to study how to encourage the adoption of mobile banking services in Ghana—services that use the payment rails of mobile money to lower transaction costs for the consumers. They use Interactive Voice Response (IVR) messages to send information to clients of a rural bank about how to access their bank account at low cost through mobile money. They find this encouragement results in more bank account transactions being conducted through mobile money, with use tripling in the treatment group. This is accompanied by an 11% reduction in visits to the bank branch, saving clients both time and money.

Finally, Bjorkegren et al. (2022) use an RCT to study a digital loan product in Nigeria. They find that receiving a digital loan increases measures of subjective well-being. They also look at whether larger loans have any impacts for those already approved for a loan and do not find this dimension matters for well-being. Neither of these treatments affects other economic outcomes.

Macroeconomic impacts of mobile money

There has also been some work on the macroeconomic impact of mobile money systems. Weil et al. (2012) use survey data from Kenya, Tanzania, and Uganda to document the rapid adoption of mobile money between 2006 and 2009 and aggregate data from the Central Bank to look for structural breaks in monetary aggregates that would suggest macroeconomic effects of mobile money. They find evidence of these effects in Kenya, though the velocity of M-PESA, computed based on aggregate data provided by Safaricom, was no higher than that of cash or other monetary aggregates. Similarly, Mbiti & Weil (2011) start by showing that the transaction velocity of M-PESA was four transactions per month in 2008, not much higher than the velocity of cash. The calculated value of outstanding e-float was 3.3 billion shillings in August 2008, also a modest value in comparison to the 85.2 billion shillings of currency (M0) on average between January and June, 2008. Analysing transactions, they conclude that M-PESA is not used as a store of value, with the average account balance of users valued at less than $10 at any point in time. More importantly, they show an effect on the prices of competitors to M-PESA (such as Moneygram and Western Union), with competitors reducing prices on transaction sizes below M-PESA’s thresholds.

Contrary to this, Mas & Klein (2012) find that the velocity of money increases considerably; however, it does not affect money supply base when e-money is based on a safe-deposit-box model. Aron et al. (2015) find little evidence of a link between mobile money and inflation using inflation forecasting models for Uganda. Simpasa et al. (2011) study the same question in Ethiopia, Kenya, Tanzania, and Uganda, highlighting the fact that mobile money could cause an increase in the velocity of money and, thus, the need for regulation to make sure such products do not undermine the effectiveness of monetary policy in these economies.

In a different vein, Jack et al. (2010) show how existing models of monetary theory can be used to think about the impact of mobile money on the operations of the financial system and the subsequent implications for monetary and regulatory policy decisions. Discussing results from household and agent surveys in late 2008, the authors show that the most common problems are agents’ lack of cash and e-money, which would give rise to price discrimination if the price of cash to e-money was not fixed. However, they argue that there may be informal credit or debit relationships between the agents and their coordinating bodies, which can be welfare improving according to the theoretical models.

References

Abiona, O and M F Koppensteiner (2020), “Financial Inclusion, Shocks, and Poverty: Evidence from the Expansion of Mobile Money in Tanzania”, Journal of Human Resources, 1018-9796R1.

Aggarwal, S, V Brailovskaya, and J Robinson (2020), “Cashing in (and out): Experimental evidence on the effects of mobile money in Malawi,” AEA Papers and Proceedings, 110: 599-604.

Ahmed, H, and B Cowan (2021), “Mobile money and healthcare use: Evidence from East Africa.” World Development, 141: 105392.

Aker, J C, R Boumnijel, A McClelland and N Tierney (2016), “Payment mechanisms and antipoverty programs: Evidence from a mobile money cash transfer experiment in Niger”, Economic Development and Cultural Change, 65(1), 1-37.

Apeti, A E (2023), “Household welfare in the digital age: Assessing the effect of mobile money on household consumption volatility in developing countries.” World Development, 161: 106110.

Apeti, A E, and E D Edoh (2023), “Tax revenue and mobile money in developing countries.” Journal of Development Economics, 161: 103014.

Aron, J, J Meullbauer and R K Sebudde (2015), “Inflation forecasting models for Uganda: is mobile money relevant?” (Vol. 44), Centre for Economic Policy Research.

Batista, C and P C Vicente (2013), “Introducing mobile money in Rural Mozambique: Initial evidence from a field experiment”, NOVAFRICA Working Paper Series, 1301.

Batista, C and P C Vicente (2020), “Improving access to savings through mobile money: Experimental evidence from African smallholder farmers”, World Development, 129, 104905.

Batista, C and P C Vicente (2022), “Is Mobile Money Changing Rural Africa? Evidence from a Field Experiment.” Review of Economics and Statistics.

Batista, C, S Sequeira and P C Vicente (2020), “Closing the Gender Gap in Financial Management and Performance: Evidence from an Experiment on Training and Mobile Savings”, Nova SBE and LSE.

Bastian, G, I Bianchi, M Goldstein and J Montalvao (2018), “Short-term impacts of improved access to mobile savings, with and without business training: Experimental evidence from Tanzania”, Documents de travail, 478.

Beck, T, H Pamuk, R Ramrattan and B R Uras (2018), “Payment instruments, finance and development”, Journal of Development Economics, 133, 162-186.

Björkegren, D, J Blumenstock, O Folajimi-Senjobi, J Mauro, and S R Nair (2022), “Instant loans can lift subjective well-being: A randomized evaluation of digital credit in Nigeria.” arXiv preprint, arXiv:2202.13540.

Blumenstock, J E (2014), “Calling for Better Measurement: Estimating an Individual’s Wealth and Well-Being from Mobile Phone Transaction Records”, UC Berkeley: Center for Effective Global Action.

Blumenstock, J, G Cadamuro and R On (2015a), “Predicting poverty and wealth from mobile phone metadata”, Science, 350(6264), 1073-1076.

Blumenstock, J E, M Callen, T Ghani (2013), “Mobile Salary Payments in Afghanistan: Policy Implications and Lessons Learned”, PEDL Research Paper (pp. 9).

Blumenstock, J E, M Callen, T Ghani and L Koepke (2015b), “Promises and pitfalls of mobile money in Afghanistan: evidence from a randomized control trial”, Proceedings of the Seventh International Conference on Information and Communication Technologies and Development (pp. 1-10).

Blumenstock, J, M Callen and T Ghani (2018), “Why do defaults affect behavior? Experimental evidence from Afghanistan”, American Economic Review, 108(10), 2868-2901.

Blumenstock, J , M. Callen and T Ghani (2020), “Violence and financial decisions: Evidence from mobile money in Afghanistan”, Working Paper, University of Washington.

Blumenstock, J E, N Eagle and M Fafchamps (2016), “Airtime transfers and mobile communications: Evidence in the aftermath of natural disasters”, Journal of Development Economics, 120, 157-181.

Brailovskaya, V, P Dupas, and J Robinson (2021), “Is digital credit filling a hole or digging a hole? Evidence from Malawi” (No. w29573), National Bureau of Economic Research.

Breza, E, M Kanz and L F Klapper (2020), “Learning to Navigate a New Financial Technology: Evidence from Payroll Accounts” (No. w28249), National Bureau of Economic Research.

Cook, T and C McKay (2015), “Top 10 things to know about M-Shwari.” CGAP Blog, available at: http://www.cgap.org/blog/top-10-things-know-about-m-shwari.

Dalton, P S, H Pamuk, R Ramrattan, B Uras, and D P van Soest (2022), “E-payment technology and business finance: A randomized controlled trial with mobile money.” CentER, Tilburg University Working Paper.

Dizon, F, E Gong and K Jones (2020), “The Effect of Promoting Savings on Informal Risk Sharing Experimental Evidence from Vulnerable Women in Kenya”, Journal of Human Resources, 55(3), 963-998.

Donovan, K (2012), “Mobile money for financial inclusion”, Information and Communications for Development, 61(1), 61-73.

Economides, N and P Jeziorski (2017), “Mobile money in Tanzania”, Marketing Science, 36(6), 815-837.

Egami, H and T Matsumoto (2020), “Mobile Money Use and Healthcare Utilization: Evidence from Rural Uganda.” Sustainability, 12(9): 3741.

Gürbüz, A (2017), “Mobile Money and Savings in Rural Kenya”, unpublished, World Bank Blog.

Habyarimana, J and W Jack (2016), “Saving for High School with a Mobile-Money LockBox”, Working Paper, Georgetown University, Washington, DC.

Iazzolino, G (2015), “Following mobile money in Somaliland”, RVI Rift Valley Forum Research Paper 4.

Jack, W and T Suri (2011), “Mobile money: The economics of M-PESA” (No. w16721), National Bureau of Economic Research.

Jack, W and T Suri (2014), “Risk sharing and transactions costs: Evidence from Kenya’s mobile money revolution”, American Economic Review, 104(1), 183-223.

Jack, W, A Ray and T Suri (2013), “Transaction networks: Evidence from mobile money in Kenya”, American Economic Review, 103(3), 356-61.

Jack, W, T Suri and R M Townsend (2010), “Monetary theory and electronic money: Reflections on the Kenyan experience”, FRB Richmond Economic Quarterly, 96(1), 83-122.

Kinnan, C (2014), “Distinguishing barriers to insurance in Thai villages”, Northwestern University, Department of Economics, Evanston, Il.

Kipchumba, E, and M Sulaiman (2021), “Digital Finance and Intra-household Decision-making: Evidence from Mobile Money Use in Kenya” Working paper.

Lee, J, J Morduch, S Ravindran, A Shonchoy and H Zaman (2019), “Poverty and Migration in the Digital Age: Experimental Evidence on Mobile Banking in Bangladesh”, Working Paper, NYU Wagner School.

Mas, I and M Klein (2012), “A note on macro-financial implications of mobile money schemes” (No. 188), Frankfurt School-Working Paper Series.

Maurer, B (2012), “Mobile money: Communication, consumption and change in the payments space”, Journal of Development Studies, 48(5), 589-604.

Mbiti, I and D N Weil (2011), “Mobile banking: the impact of M-Pesa in Kenya” (No. w17129), National Bureau of Economic Research.

Morawczynski, O (2009), “Exploring the usage and impact of ‘transformational’ mobile financial services: the case of M-PESA in Kenya”, Journal of Eastern African Studies, 3(3), 509-525.

Morawczynski O and M Pickens (2009), “Poor People Using Mobile Financial Services: Observations on Customer Usage and Impact from M-PESA” (No. 9492), The World Bank.

Munyegera, G K and T Matsumoto (2014), “Mobile money, remittances and rural household welfare: Panel evidence from Uganda”, Tokyo: GRIPS.

Plyler, M, S Haas and G Nagarajan (2010), “Community-level economic effects of M-PESA in Kenya: Initial findings”, Financial Services Assessment: College Park, MD, USA, 1-8.

Pople A, R Hill, S Dercon and B Brunckhorst (2021), “Anticipatory cash transfers in climate disaster response.” Centre for Disaster Protection.

Riley, E (2018), “Mobile money and risk sharing against village shocks.” Journal of Development Economics, 135: 43-58.

Riley E (2022), “Resisting Social Pressure in the Household Using Mobile Money: Experimental Evidence on Microenterprise Investment in Uganda.” CSAE Working Paper.

Riley, E and A Shonchoy (2022), “A National Information Campaign Encouraging Financial Technology Use in Ghana” (No. 2206). Florida International University, Department of Economics.

Simpasa, A, D Gurara, A Shimeles, D Vencatachellum and M Ncube (2011), “Inflation Dynamics in selected East African countries: Ethiopia, Kenya, Tanzania and Uganda”, AfDB Policy Brief.

Suri, T (2014), “Estimating the extent of local risk sharing between households”, Working Paper, Sloan School Manag., Mass. Inst. Technol., Cambridge, MA.

Suri, T (2021), “Fintech and household resilience to shocks: Evidence from digital loans in Kenya” Journal of Development Economics, 153: 102697.

Suri, T, W Jack and T M Stoker (2012), “Documenting the birth of a financial economy”, Proceedings of the National Academy of Sciences, 109(26), 10257-10262.

Suri, T and W Jack (2016), “The long-run poverty and gender impacts of mobile money,” Science, 354(6317), 1288-1292.

Weil, D, I Mbiti and F Mwega (2012), “The implications of innovations in the financial sector on the conduct of monetary policy in East Africa”, Report submitted to the International Growth Centre Tanzania Country Programme.

Wieser, C, M Bruhn, J P Kinzinger, C S Ruckteschler, and S Heitmann (2019), “The impact of mobile money on poor rural households: Experimental evidence from Uganda.” World Bank Policy Research Working Paper, (8913).

Contact VoxDev

If you have questions, feedback, or would like more information about this article, please feel free to reach out to the VoxDev team. We’re here to help with any inquiries and to provide further insights on our research and content.